Physical Address

Nairobi, Kenya, 00100

Physical Address

Nairobi, Kenya, 00100

Discover how to pay taxes in Kenya without hassle. Our guide provides you with the necessary information to file your taxes accurately.

Navigating the complexities of the Kenyan tax system can be daunting, but understanding its fundamentals is crucial for both individuals and businesses. This article breaks down the process of how to pay taxes in Kenya.

Are you aware of the essential steps to fulfill your tax obligations efficiently? This guide will walk you through the process, covering key aspects such as registration requirements, payment methods, and common pitfalls to avoid when dealing with the Kenya Revenue Authority.

Understanding how to properly manage your tax compliance is not only vital for legal adherence but also for contributing to national development and avoiding unnecessary penalties.

Understanding the Kenyan tax system is crucial for individuals and businesses operating in Kenya. The system is designed to fund essential government services and infrastructure development, making compliance a civic responsibility.

The Kenya Revenue Authority (KRA) serves as the central government agency responsible for assessing, collecting, and accounting for all tax revenue in Kenya. To enable it to carry out its mandate, every natural or legal person is required to register and obtain a Personal Identification Number (PIN). This enables persons to effectively pay their tax obligations and file returns.

Tax compliance in Kenya goes beyond just paying taxes; it involves proper registration, timely filing of returns, and maintaining accurate records of all financial transactions. A tax compliance certificate is often required for various business operations, including bidding for government tenders and renewing certain licenses. Non-compliance can result in significant penalties, including fines and interest charges.

To navigate Kenya’s tax landscape effectively, it’s essential to know the different types of taxes applicable. Kenya’s tax system is designed to cater to various aspects of economic activity, ensuring that the government can fund public goods and services. The main categories of taxes include income-based taxes, consumption taxes, property taxes, and other important taxes.

Income-based taxes are levied on the income earned by individuals and corporations. Pay As You Earn (PAYE) is a method of collecting tax at source from individuals in gainful employment, including workers of religious organizations and foreign missions working in Kenya. Employers deduct PAYE directly from employee salaries before payment. Corporation tax, on the other hand, is applicable to companies operating in Kenya, taxing their profits.

The PAYE system simplifies tax compliance for employed individuals, as the tax is deducted at source. For corporations, understanding the corporation tax rate and how it applies to their profits is crucial for financial planning.

Consumption taxes are imposed on the consumption of goods and services. Value Added Tax (VAT) is charged at a rate of 16% on most goods and services in Kenya, although certain essential items are zero-rated or exempt. Excise duty is levied on specific goods and services considered luxurious, harmful, or environmentally impactful, such as alcohol, tobacco, and financial services.

Understanding VAT and excise duty is vital for businesses, as it affects their pricing strategies and compliance requirements. Consumers also need to be aware of these taxes to understand the final cost of goods and services.

Rental income tax applies to property owners earning rental income. For residential properties earning up to Ksh10 million annually, a simplified tax rate of 10% on gross rental receipts is applicable. This tax is paid on a monthly basis, simplifying compliance for property owners.

Other significant taxes include withholding tax and advance tax. Withholding tax applies to various payments such as dividends, interest, royalties, and professional fees, with rates varying depending on whether the recipient is a resident or non-resident. Advance tax is required for commercial vehicle owners, who must pay this tax before their vehicles can be licensed for operation on Kenyan roads.

Additionally, turnover tax at a rate of 3% applies to small businesses with an annual turnover below Ksh5 million, offering a simplified taxation method for small enterprises.

| Tax Type | Description | Rate |

|---|---|---|

| PAYE | Tax on employment income | Progressive rates |

| VAT | Value Added Tax on goods and services | 16% |

| Excise Duty | Tax on specific goods and services | Varies |

| Rental Income Tax | Tax on rental income from residential properties | 10% on gross rent |

| Withholding Tax | Tax on various payments like dividends and interest | Varies |

| Advance Tax | Tax on commercial vehicles | Varies by vehicle type |

| Turnover Tax | Tax for small businesses with low turnover | 3% on gross income |

To start your tax journey in Kenya, registration with the Kenya Revenue Authority (KRA) is a crucial first step. Every taxpayer, whether an individual or business entity, must register and obtain a Personal Identification Number (PIN) before engaging in any taxable activities.

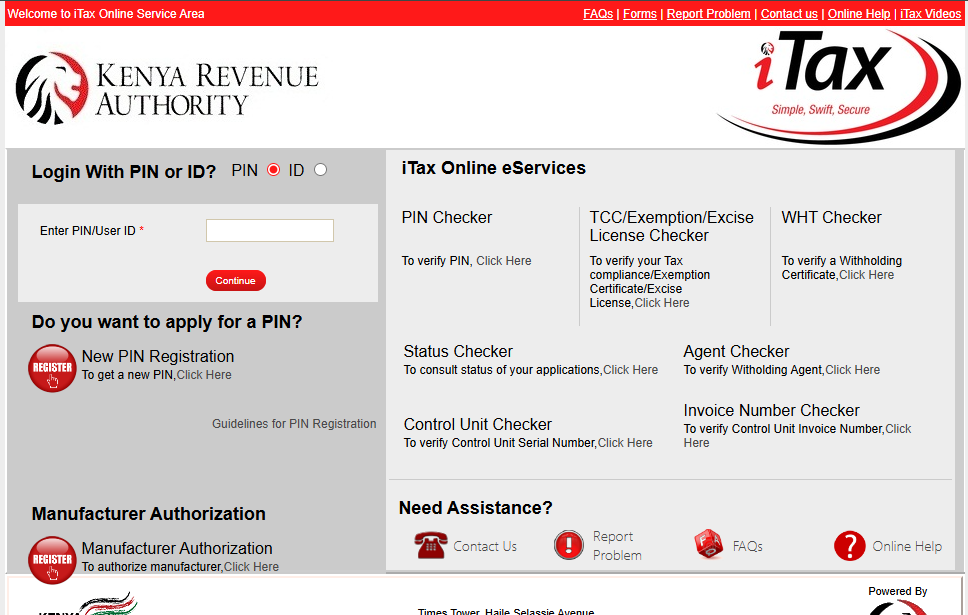

The individual PIN registration process has been simplified through the iTax online portal, allowing Kenyans to complete their registration without visiting KRA offices in person. To register, you’ll need to provide your national ID or passport, a valid email address, and your current contact information.

After completing your PIN registration, you’ll need to activate your iTax account to begin filing returns and making tax payments through the online system.

Business tax registration requirements vary depending on the type of entity, with sole proprietorships, partnerships, and companies each having specific documentation needs. Foreign businesses operating in Kenya must also obtain a PIN and may need additional permits depending on their sector and activities.

Your PIN certificate is a crucial document that will be required for numerous transactions in Kenya, including opening bank accounts and registering property.

To fulfill your tax obligations in Kenya, follow this step-by-step guide on making tax payments. Paying taxes is an essential civic duty that supports the country’s development.

The iTax platform serves as the central hub for all tax-related activities in Kenya, including registration, filing returns, and initiating payments for various tax obligations. To start, you need to file your tax returns through the iTax system, which calculates your tax liability.

After filing, the system generates a payment slip with a unique Payment Registration Number. This number is crucial for making payments through approved methods.

Kenya offers multiple payment methods for taxes, including bank transfers and M-Pesa. To pay via M-Pesa, use the KRA paybill number 222222 and enter your Payment Registration Number as the account number.

You can also make payments at any of the KRA-appointed banks by presenting your generated payment slip.

Filing deadlines vary by tax type. For instance, monthly taxes like PAYE and VAT are due by the 20th of the following month, while annual returns must be filed by June 30th each year.

It’s essential to mark these deadlines on your calendar to avoid late payments and filings, which incur penalties and interest charges.

To navigate the Kenyan tax system effectively, understanding how to avoid tax penalties is crucial. The Kenya Revenue Authority (KRA) imposes penalties for non-compliance, which can significantly impact your financial obligations.

Taxpayers in Kenya often make mistakes that lead to penalties, such as missing filing deadlines and incorrect classification of income or expenses. Ensuring proper documentation for business transactions is also vital. Underreporting income or overstating expenses can trigger KRA audits, resulting in substantial penalties. Businesses dealing with imports must correctly classify goods for customs duty and excise tax purposes to avoid retroactive assessments.

If you miss a tax deadline, it’s advisable to file and pay as soon as possible to minimize accruing penalties. The KRA offers tax amnesty programs periodically, providing opportunities to regularize your tax affairs with reduced or waived penalties. Maintaining an up-to-date tax compliance certificate requires consistent adherence to all tax obligations, including timely filing of nil returns. Seeking professional advice from a qualified tax agent can help prevent costly mistakes and negotiate with authorities.

Ultimately, understanding and adhering to Kenya’s tax regulations can save you from unnecessary penalties and stress. To navigate Kenya’s tax system successfully, it’s crucial to comprehend the various types of taxes applicable to your situation. Proper registration, including obtaining your individual PIN, is foundational for hassle-free tax compliance. The iTax platform has streamlined the process, making it easier to file returns and make payments. Staying informed about deadlines and requirements helps avoid compounding penalties. For complex matters, seeking professional guidance can save you money and stress in the long run.

The KRA is responsible for collecting and managing revenue on behalf of the government, including income tax, Value Added Tax (VAT), and excise duty.

You can register for a PIN through the KRA’s iTax platform, providing required personal and identification details to obtain your unique tax identifier.

The deadline for filing tax returns varies depending on the type of tax; missing the deadline can result in penalties and fines, so it’s essential to check the KRA’s guidelines and plan accordingly.

You can pay your taxes via M-Pesa by using the KRA’s paybill number, ensuring you enter the correct details, such as your PIN and tax type, to avoid any issues.

Withholding Tax is a tax deducted at source by the payer on certain payments, such as rental income or professional fees; the payer is required to remit this tax to the KRA on behalf of the recipient.

Yes, you can claim a credit for Advance Tax paid when filing your tax return, provided you have the necessary documentation and have made the payment through the approved channels.

A Tax Compliance Certificate is required for various business and official purposes, verifying that you are up-to-date with your tax obligations; you can obtain it by ensuring your tax affairs are in order and applying through the KRA’s iTax platform.

VAT applies to the supply of goods and services; your business must register for VAT if its turnover exceeds the threshold set by the KRA, and you will need to charge VAT on your sales and claim it back on your purchases.